23+ loan to value mortgage

The loan terms most commonly offered are 15 years and 30 years. LTV is an indicator of how much youre borrowing relative to the value of.

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

For example if a lender grants you.

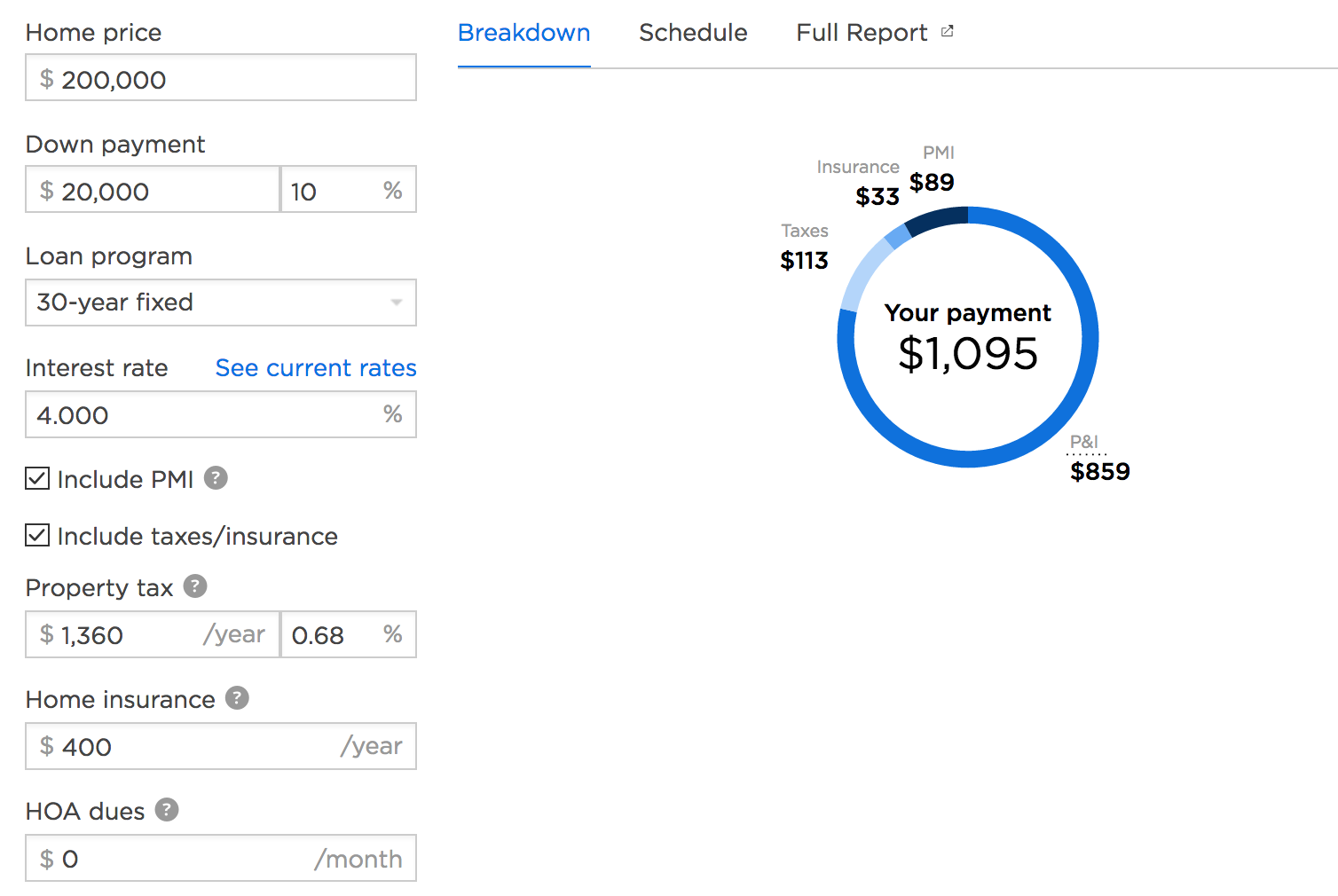

. Mr Mortgage Required. Estimate your monthly mortgage payment. To calculate your LTV.

Lock Your Rate Today. Ad 10 Best House Loan Lenders Compared Reviewed. Loan to Value LTV Ratio 320000.

Comparisons Trusted by 55000000. Web Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage. Web The loan-to-value ratio is calculated by dividing the loan or mortgage amount by the propertys appraised value.

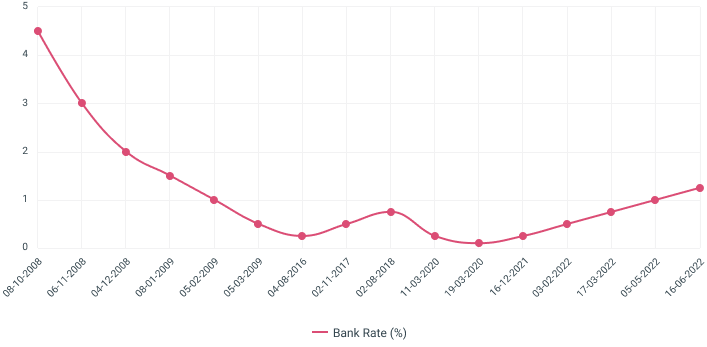

The average rate for a 30-year fixed mortgage is 708 the average rate youll pay for a 15-year fixed mortgage is 633. Web Mortgage rates continue to increase. Web Compared to a 30-year fixed mortgage a 15-year fixed mortgage with the same loan value and interest rate will have a higher monthly payment.

Ad Our Simple Guide Will Help You Understand Common Mortgage Terms. Get Instantly Matched With Your Ideal Mortgage Lender. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web High Loan To Value Mortgage - If you are looking for suitable options then our comfortable terms are just what you are looking for. Web LTV represents the proportion of an asset that is being debt-financed. The loan-to-value ratio is a measure of.

Web Loan-to-value ratios are easy to calculate. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Va to value ratio 80 to value ratio ltv low to.

Just divide the loan amount by the most current appraised value of the property. LTVs tend to be higher for assets that. Lock Your Rate Today.

The resulting amount is then multiplied by 100. Its calculated as Loan Amount Asset Value 100. Comparisons Trusted by 55000000.

For example if youre buying a 100000 property with a 10000 10 deposit youll. Web LTV Loan to Value. If your home is worth 200000 and you have a.

Understand The Home Buying Process Better. Ad Weve Researched Lenders To Help You Find The Best One For You. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web Maximum Loan-to-Value Ratio. Web The loan-to-value LTV ratio is the percentage of your homes appraised value or purchase price if it is lower that you are borrowing.

Web Current combined loan balance Current appraised value CLTV. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The higher your down payment the.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your responsibility. Get Instantly Matched With Your Ideal Mortgage Lender.

Web The loan-to-value ratio or LTV is a factor lenders use to help determine the risk of a loan. Save Real Money Today. See How Much You Can Save with Low Money Down.

Web One important factor to consider when choosing a mortgage is the loan term or payment schedule. Web Your loan to value ratio LTV compares the size of your mortgage loan to the value of the home. The maximum ratio of a loans size to the value of the property which secures the loan.

Ad Top Home Loans. The 15-year fixed mortgage has an average rate of. Web Loan-To-Value Calculator Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the.

You currently have a loan balance of 140000 you can find your loan balance on your monthly loan. So a maximum LTV of 90 is basically the same as saying a minimum of 10 deposit required at the end of. Pp Property Price.

Ad See how much house you can afford. Web PMTannual interest ratenumber of payment periodsnumber of years of the loanpresent value of the loan If calculating the monthly payment on a 30-year fixed-rate mortgage. Web The loan-to-value LTV ratio is a measure comparing the amount of your mortgage with the appraised value of the property.

Ad 10 Best House Loan Lenders Compared Reviewed.

The Household Debt Ratio Is An Unsuitable Risk Measure There Are Much Better Ones Lars E O Svensson

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Do Loan To Value And Debt To Income Limits Work Evidence From Korea In Imf Working Papers Volume 2011 Issue 297 2011

Loan To Value Calculator Mortgage Calculators

The V In Ltv And Why It Matters Ecbc

The Manual Of Ideas Large Cap Stocks How Cheap Are They By Beyondproxy Llc Issuu

Insurance And Financial Services Uae By Go Finance Issuu

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Loan To Value Calculator Nerdwallet

Loan To Value Ratio Calculator Tdecu

What Is A Loan To Value Ratio

Loan To Value Ratio Ltv 99 Co

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

What Does Loan To Value Ltv Mean How To Calculate Ltv

What Is Ltv How To Calculate Ltv Loan To Value Ratio

What Does Loan To Value Ltv Mean How To Calculate Ltv

Loan To Value Ltv Calculator Calculate Ltv L C Mortgages